How we help you in making the right decision…

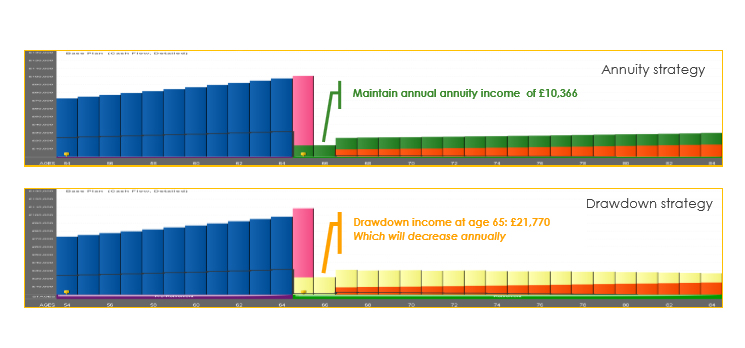

The graphs overleaf compare a client’s situation if they were to retire at the age of 55, choosing either the annuity (the green bars) or drawdown income (the yellow bars) of income payment during retirement.

We have assumed that the client takes out the, under current legisla- tion, allowed tax free lump sum of 25% (shown in pink).

Your big decision: Income Drawdown vs. Annuity

The big decision is whether you take out this pension as an annuity (a financial product, which guaran- tees to pay a fixed amount every year, providing certainty through- out retirement) or if you opt for an income drawdown (this method leaves your pension fund invested in securities. You draw an income from this fund whenever needed).

The top graph represents the scenario where they take out an annuity upon retirement. He has a smaller yearly income than in the next case but rarely has to dip into his savings to cover his expenses.

The second graph represents the situation where they opt for income drawdown. The yearly income varies, giving the client more flexibility. The annual drawdown amount reduces over the years. The client has to dip into his savings and even has a small shortfall later in life.